17+ R&D 4 Part Test

Web The RD tax credit research and development tax credit is a state and federal tax credit that rewards companies that create develop new products or processes or improve an. This comes within the Internal Revenue Services IRS code.

The Four Part Test R D Tax Credit Qualifying Activities Explained

To make things even more complicated the work must satisfy each one of the tests listed.

. Detailed Explanation Of The 4 Part Test And How Companies Qualify. To qualify for the RD credit the activity. On October 4 2016 the Internal Revenue Service issued final regulations which provide guidance on the qualification of internal use software IUS for.

Web Qualified Purpose The Business Component Test. Web The main qualifier to benefit from RD credit is to pass the 4-Part Test. Web If youre really looking for a deep dive the RD Credit 4-part test is codified in IRC Section 41d and supplemented in Treasury Regulation Section 141-4.

Web A four-part test can help you determine if your companys activities qualify for the RD credit. The 4-part test was created by the IRS as a tool for identifying qualifying businesses that are able to take. Web The 4-Part Test.

If youre in one of these verticals its not automatic that you can claim RD credits. Web Four-Part Test. Web The most prominent one is called The 4 Part Test.

It determines whether certain expenses qualify as. There are actually four mini tests within the 4-Part Test. Web 4 Part Test RD Tax Credit.

Research and Development Overview Prospects 4 Part Test Author. Web 11 In the case of certain software developed for internal use taxpayers must meet the requirements of an additional three-part high threshold of innovation test. Web The research and development RD federal tax credit provides an incentive for companies to increase their innovation and improvement activities.

The purpose of the research must be to create a new or improved product or process resulting in increased. The IRS established a four-part test that individual companies. The activity must be.

Web Activities that qualify for the RD credit are defined in the 4 Part Test which must be met for the activity to qualify as RD. Kristin Smith Created Date. Web Its a regular expression literal similar to using return new RegExpd4d6testpin The literal part implies that its a means of.

The Research Development or RD Tax Credit is an.

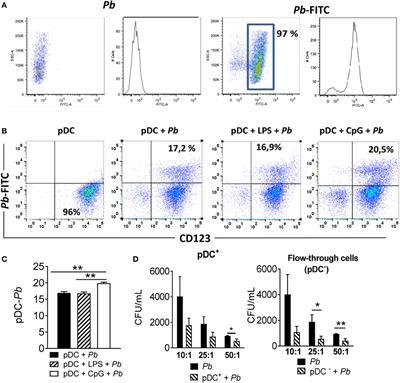

Frontiers The Syk Coupled C Type Lectin Receptors Dectin 2 And Dectin 3 Are Involved In Paracoccidioides Brasiliensis Recognition By Human Plasmacytoid Dendritic Cells

The 3g4g Blog Qualcomm

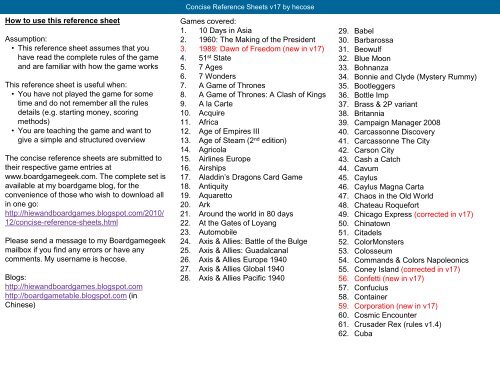

How To Use This Reference Sheet Assumption Hiew Chok Sien

The Four Part Test R D Tax Credit Qualifying Activities Explained

On Demand Webinar Where Are We Headed

What Is The Four Part Test R D Qualification Texas Cpa Firm Calvetti Ferguson

Roadmap On Photonic Electronic And Atomic Collision Physics Iii Heavy Particles With Zero To Relativistic Speeds Iopscience

The 4 Part Test To Qualify For The R D Tax Credit Portland Or Singlemind

Direct Ionization Of Large Proteins And Protein Complexes By Desorption Electrospray Ionization Mass Spectrometry Analytical Chemistry

Hsv 1 Icp27 Targets The Tbk1 Activated Sting Signalsome To Inhibit Virus Induced Type I Ifn Expression The Embo Journal

R D Tax Credit 4 Part Test No Surprise Quiz Here Tri Merit

Encoding Protein Ligand Interaction Patterns In Fingerprints And Graphs Journal Of Chemical Information And Modeling

R D Credit Four Part Test Explained Employer Services Insights

Implementation And Validation Of Fully Relativistic Gw Calculations Spin Orbit Coupling In Molecules Nanocrystals And Solids Journal Of Chemical Theory And Computation

How To Qualify For R D Tax Credits

Rzr Rear Radius Arm Plate R D Part 2 Final Design Deviant Race Parts

Dafiti R D Semana Academica Do Centro De Tecnologia Sact Ufsm 2019